Newsie Events :–

The Central Bank of Nigeria (CBN) has announced a new policy that seeks to limit over-the-counter cash withdrawals by individuals and corporate entities to N100,000 and N500,000 per week, respectively.

This development is coming barely

few weeks after the newly redesigned N200, N500, and N1000 banknotes were launched by President Muhammadu Buhari’s government.

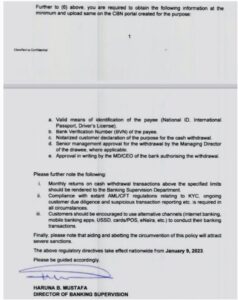

CBN in a circular it issued on Tuesday, said the new directive will take effect nationwide on January 9, 2023

Following the implementation of the policy, all cash withdrawals in excess of the above mentioned restrictions will be subject to processing costs of 5 and 10 per cent, respectively.

The circular reads in parts, “Further to the launch of the redesigned Naira notes by the President of the Federal Republic of Nigeria, on Wednesday, November 23, 2022 and in line with the Cash-less policy of the CBN, all deposit money banks (DMBs) and other financial institutions (0F1s) are hereby directed to note and comply with the following:

1. The maximum cash withdrawal over the counter (OTC) by individuals and corporate organizations per week shall henceforth be N100.000 and N500,000 respectively.

Withdrawals above these limits shall attract processing fees of 5% and 10%, respectively.

2 Third party cheques above N50,000 shall not be eligible for payment over the counter, while extant limits of 110,000.000 on clearing cheques still subsist.

3. The maximum cash withdrawal per week via Automated Teller Machine (ATM) shall be N100.000 subject to a maximum of N20,000 cash withdrawal per day.

4 Only denominations of N200 and below shall be loaded into the ATMs.

5 The maximum cash withdrawal via point of sale (PoS) terminal shall be N20.000 daily.

Newsie Events recalled that the CBN governor, Godwin Emefiele, in October, revealed that the apex bank had lost track of N2.7 trillion of the country’s currency currently in circulation.

He lamented that Nigerians were hoarding bank notes, refusing to take them to banks.

NEWSIE EVENTS MEDIA TEAM Follow Us On Twitter: @NewsieEvents, Instagram: newsieevents, Facebook: Newsie Events (Subscribe to our YouTube Page: Newsie Eventsng. LinkedIn Newsie Events